.jpg)

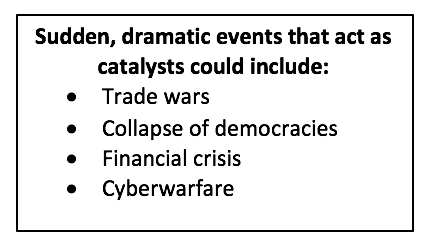

World leaders are meeting in Davos this week for the annual World Economic Forum (WEF), where they’ll discuss how to prepare for what their new report says could be the most dangerous year ever. We’ll hope that they come up with some good solutions, but in the meantime, we’ve been pouring over the Global Risks Report 2018, which leads us to believe that we’ve got one very risky year ahead of us.

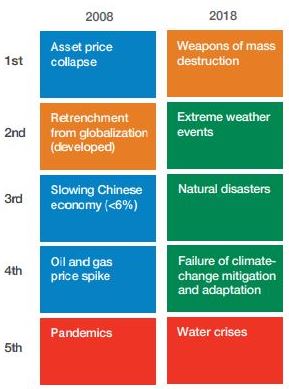

A decade of difference:

Top 5 global risks in terms of likelihood

Top 5 global risks in terms of impact

Source: World Economic Forum 2008-2018, Global Risks Reports

CRI asked Zurich’s lead global risk expert John Scott, one of the chief contributors to the report, for his top five key takeaways. Here are his picks, with comment from other leading WEF contributors:

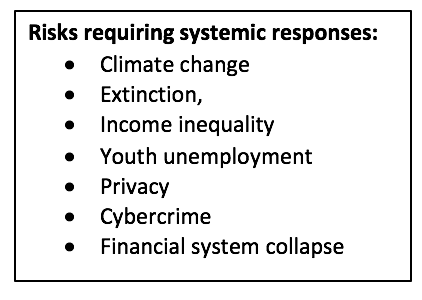

Environmental risks were by far the largest threat identified in the report. That’s unsurprising given that 2017 recorded some of the costliest natural catastrophes on record. “What’s striking this year is that environmental risks are all considered as highly likely and potentially very impactful,” says Margareta Drzeniek Hanouz, head of economic progress at WEF. “This is a new finding this year.”

Cyber risks also rose in the threat rankings for 2018, highlighting their increasingly incidence and disruptive potential. “The aggregate cost of cyber is now estimated by a number of sources to be more than a trillion dollars per year in economic cost versus roughly US$300bn experienced in 2017 from losses from natural catastrophes – and that was a record year,” says John Drzik, president of global risk and digital at Marsh.

Attacks are expected to become even more sophisticated and damaging in 2018. “Looking forward, both business and government need to think about increasing investment in cyber risk management,” says Drzik. “We’re still under-resourced in the amount of effort being put into trying to mitigate this risk.”

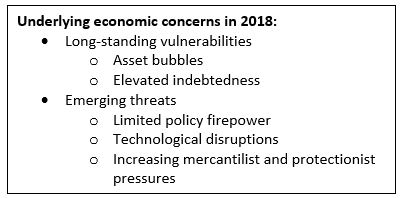

The economy isn’t top of mind these days, but several underlying issues could make it this year’s sleeper risk. “The global economy has been picking up. This could lead to complacency about many of these risks,” says Drzeniek Hanouz.

The IMF world economic outlook recently projected a 3.7% annual growth rate for 2018 – up from 3.2% for 2017. That’s a remarkable recovery from the global crisis a decade ago, but WEF warns that we could currently be seeing things through rose-colored glasses. “There are still serious concerns in societies about whether that growth is translating into broad-based progress in living standards,” says Richard Samans, managing director, WEF. He cites a widening gender pay gap and declining wages as important sources of potential friction.